Cannes Lions

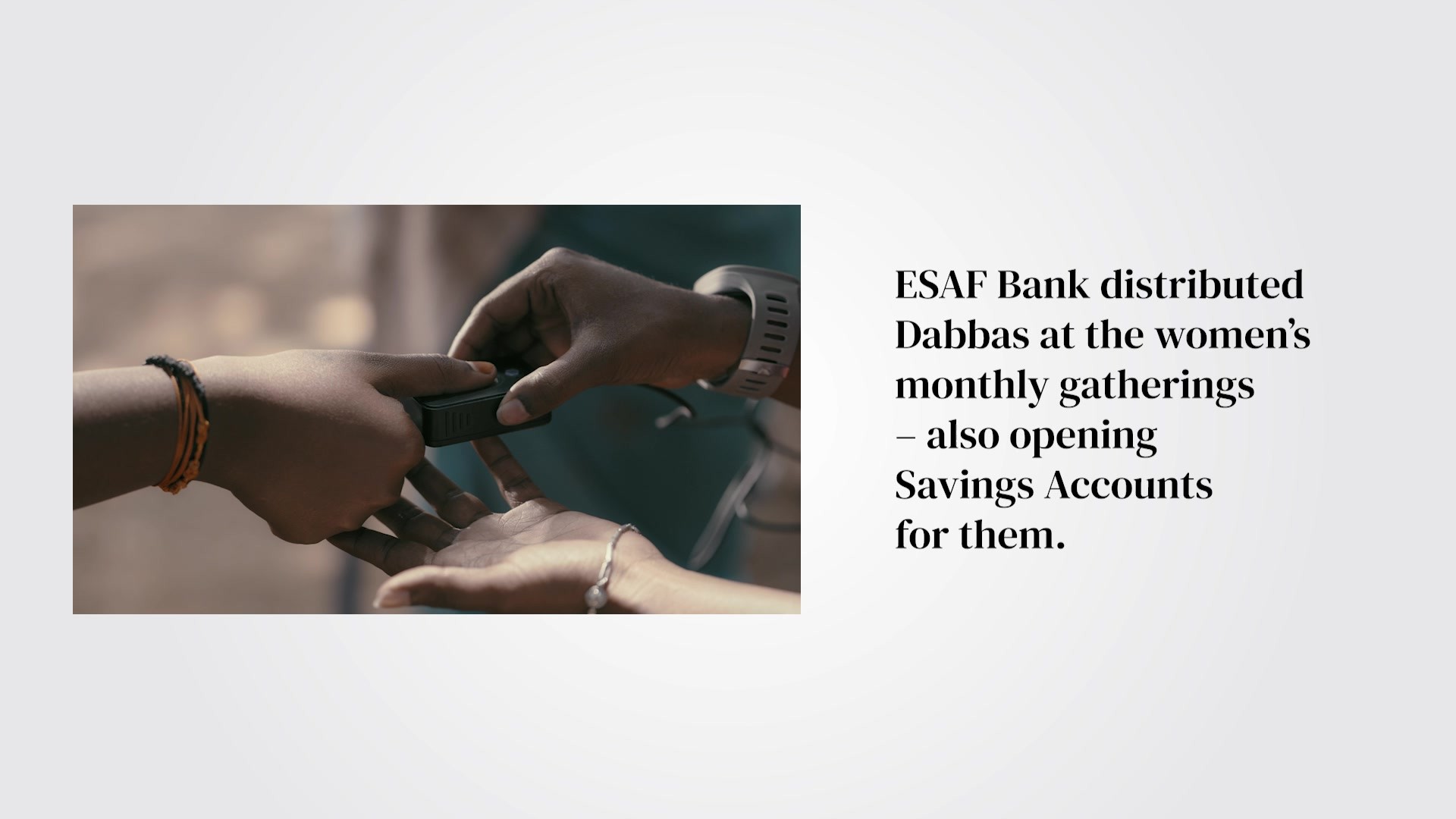

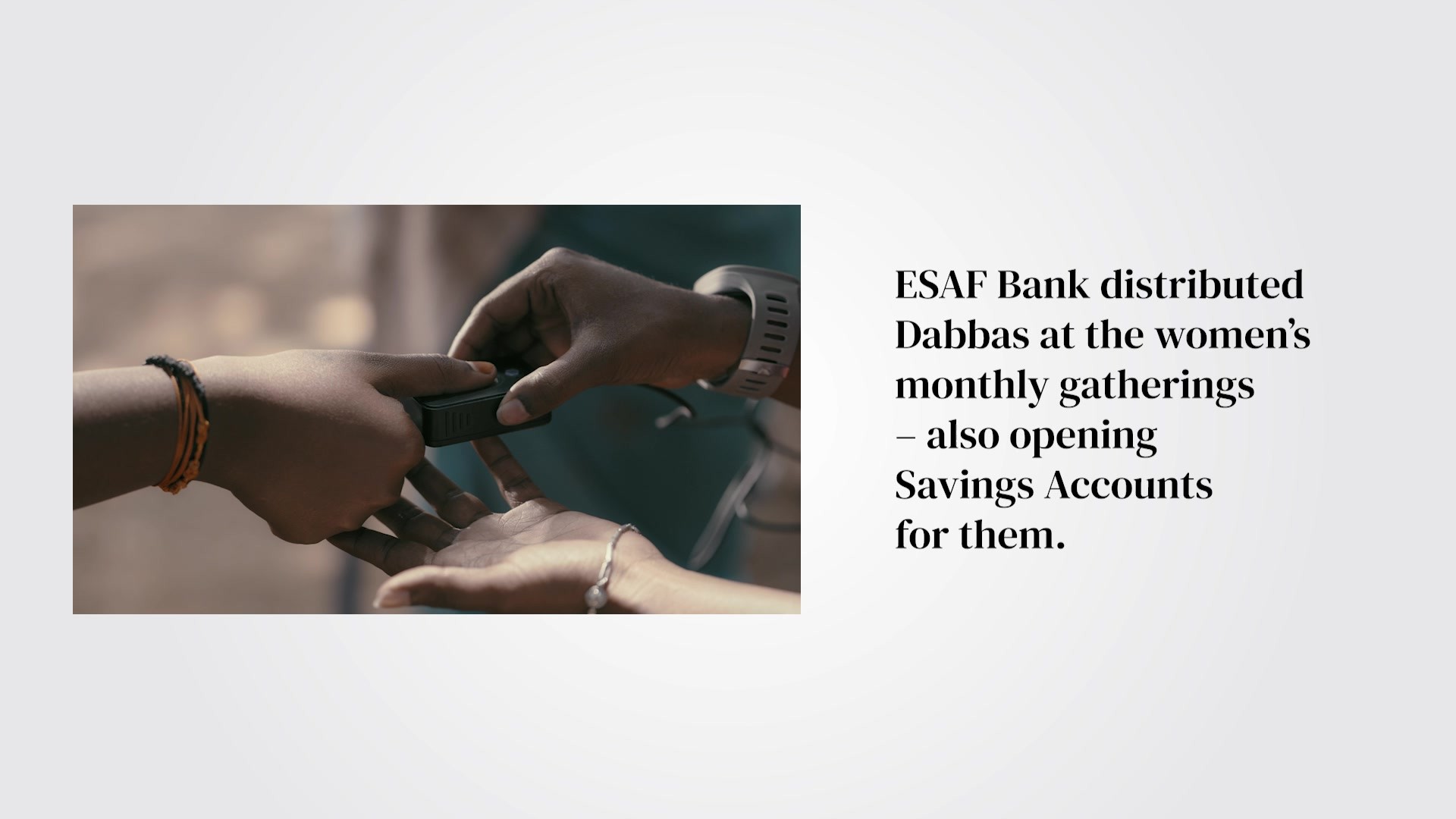

Dabba Savings Account

McCANN, Gurugram / ESAF SMALL FINANCE BANK / 2024

Awards:

1 Bronze Cannes Lions

1 Shortlisted Cannes Lions

1 of 0 items

Overview

Entries

Credits

Cannes Lions

McCANN, Gurugram / ESAF SMALL FINANCE BANK / 2024

Awards:

Overview

Entries

Credits