Eurobest

DO Black - The carbon limit credit card

RBK COMMUNICATION, Stockholm / DOCONOMY / 2019

Awards:

Overview

Entries

Credits

OVERVIEW

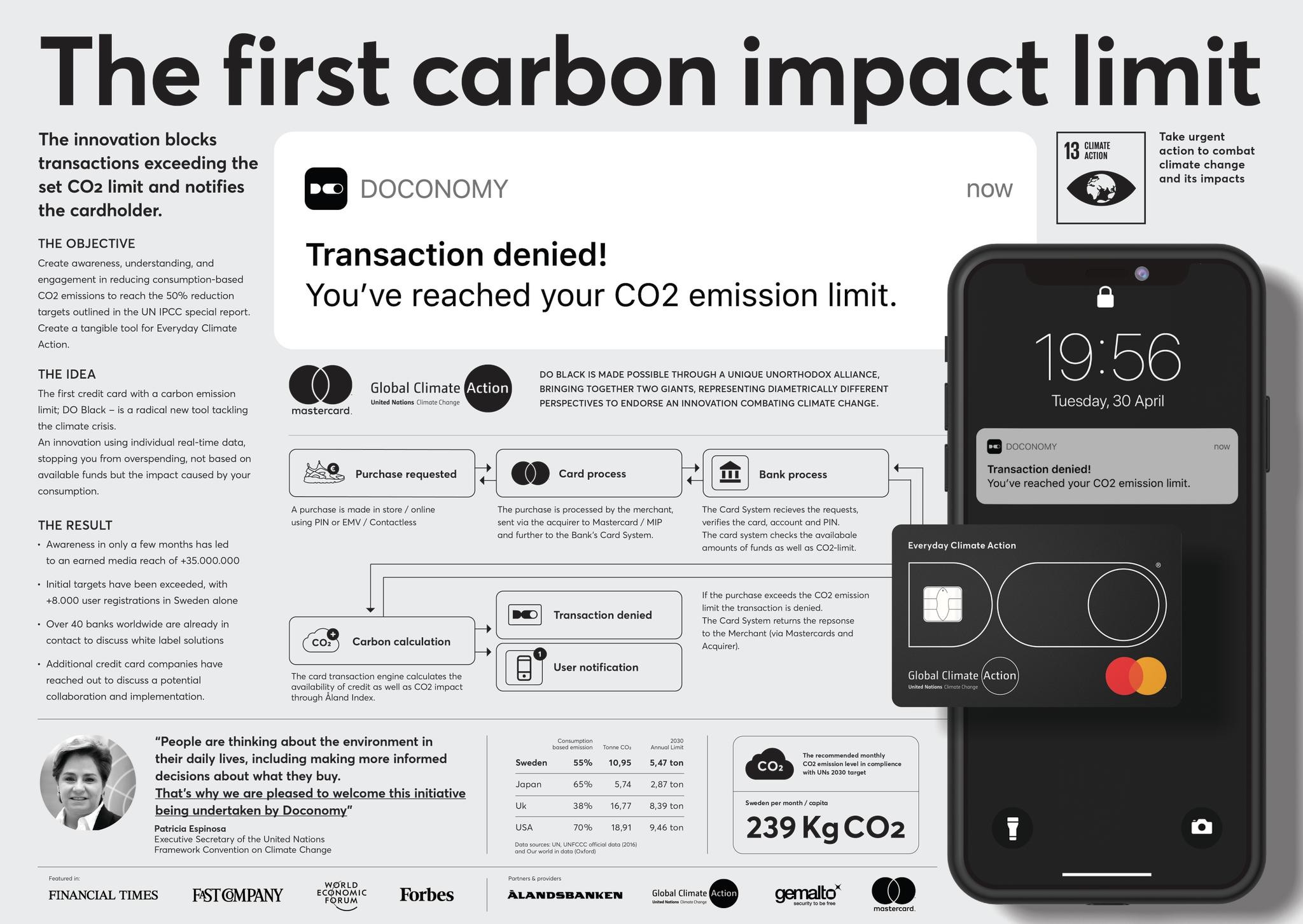

Background

Doconomy is a Swedish fin-tech dedicated to providing tools to reduce and compensate for individual CO2-impact.

When UN released the IPCC report outlining the needed for cuts in CO2 emissions, Doconomy wanted to further reinforce its commitment.

The challenge was to ensure an absolute understanding of the required cuts in CO2 emissions needed to achieve a 50% reduction by 2030 and to position Doconomy with limited resources in a crowded fintech environment, as a unique agent for change.

Working closely with UNFCCC and Mastercard, the first CO2-emission limit linking consumption with its impact was developed, and DO Black, the first carbon limit credit card was introduced.

The objective is to make Doconomy perceived as a tangible solution, resulting in awareness, user adoption and productive new partnerships.

Idea

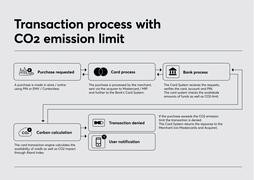

DO Black is a unique creative use of data to in a significant way activate and engage both for brand affinity and change of behaviour. About 60% of a person's carbon footprint derives from consumption. Changing consumer behavior can significantly reduce CO2-emissions. DO Black is a radical tool and the first credit card with a CO2-emission limit, stopping you from overspending, not based on available funds but on the impact by your consumption. The consumer journey includes three the ability to measure the impact of every transaction (Åland Index), the set CO2-emission limit calculated per country/capita, and a CO2-emission limit overriding accounts credit level.

Strategy

The strategy was to gather data that was undeniable relevant down to an individual level as well as correct on a expert level. The interpretation needed to be executed by leading providers in all fields connected. MasterCard as a user payment transaction data provider. Thomson Reuters and Sustainalytics as financial risk analysis data provider. KPMG as aggregating environmental data per merchant category. The World Bank as independent point of reference for the socioeconomic carbon emission cost. The users data is made actionable by individual targeting of the notifications as well as individual aggregated CO2-level.

Execution

The need for tools to tackle the climate crisis is very large and the brand market fit is substantiated by data; 98% of the Swedes believe we are impacted by climate change. 78% want to mitigate it on a personal level. 70% say habits are an obstacle and 65% would change bank for a climate smart alternative. Sources: Naturvårdsverket, 2018. WWF Survey Climate Change, Earth Hour 2016.

The strategy with DO Black is to accelerate the understanding of your impact, by having it directly halted thus pioneering conscious consumption, and actively engage with other payment providers to do the same. This approach was accelerated by standing on the shoulders of giants like UN, Mastercard and Standard & Poors amongst other for reach beyond our own capabilities.

2018, March, tech pre-study with Ålandsbanken

2018, June, Tech dev of first platform

2018, September, negotiations with UN

2018, October, com-launch of Doconomy platform

2019, February, MOU from UN

2019, March, Approval from Mastercard

2019, March, Tech dev IRL CO2 limit

2019, April, Patent registration process

2019, April, Launch of the DO Black campaign (Digital, SoMe and PR)

2019, June, Patent filed

2019, November, first bank up start for implementation

Outcome

Long-term outcome is to increase awareness and contribute to drastic reduction of CO2-emissions from consumption with 50% by 2030 and the intention to make Doconomy perceived as a (1) helpful solution, (2) resulting in awareness, (3) user adoption and (4) productive partnerships.

1. “DO Black” is in production with CO2-limit per country/capita calculated.

2. Awareness built with earned media reach of +35 000 000, +40 000 unique visitors and keynotes at sustainability/fintech summits worldwide.

3. All initial targets have been exceeded, with +8 000 user registrations in Sweden alone.

4. +40 banks worldwide and credit card companies have reached out to discuss collaboration. Ms. Espinosa, UNFCCC has a publicly endorsed Doconomy and Mastercard has defined Doconomy as “the future of sustainable payments”.

Similar Campaigns

4 items