Cannes Lions

Loveable Disruptors

McCANN MANCHESTER, Manchester / ALDI UK / 2024

Overview

Entries

Credits

OVERVIEW

Background

Business:

Return Aldi to growth, reaching 9% value share by end of 2023.

After significant growth, the onset of Coronavirus pushed Aldi’s market-share into decline, from 8.2% to 7.5% within three months.

Achieving value share of 9% would equal £13.039bn in annual sales.

Marketing:

Increase Aldi’s penetration with pre-family audiences +50% by end of 2023.

Falling penetration was the major contributor to Aldi’s drop in market share. Once lockdowns ended, Aldi sought to restore and then grow their penetration levels.

Aldi set the specific objective of growing penetration amongst pre-family shoppers from 43.6% to 50% by end of 2023.

Communications:

Make Aldi the most famous supermarket on social media by end of 2023.

Aldi aimed to double reach on social from 2.6 million impressions in 2020 - particularly beyond the 1.8 million on Facebook (66% of total) and achieve a brand salience score of 120 with pre-family audience, +15.38% increase.

Idea

The Big Hits

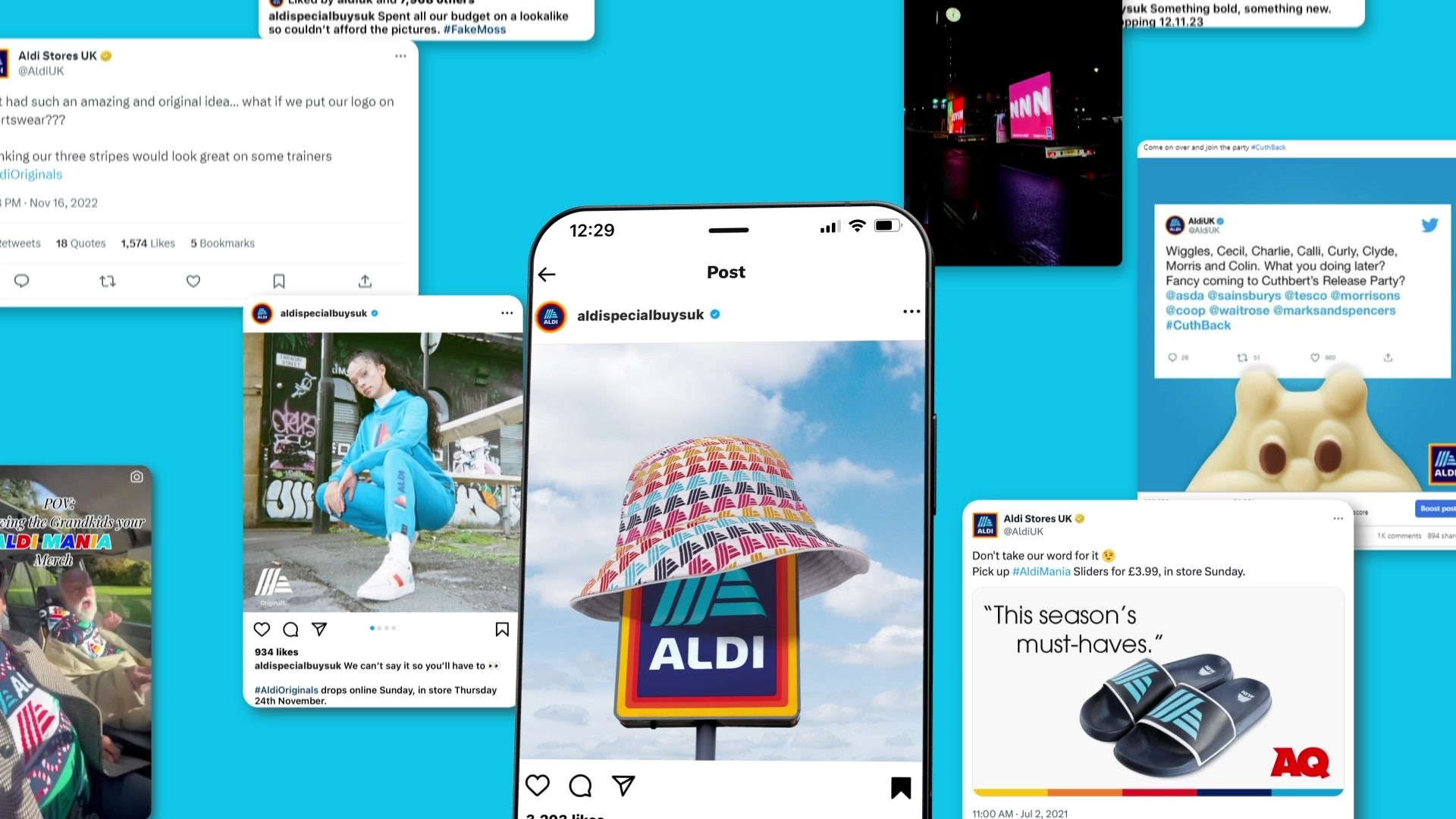

#FreeCuthbert – April 2021

M&S initiated legal proceedings over a copy-caterpillar cake.

Aldi responded with humour, cheek, and self-deprecation.

Aldi-Mania – April 2021

Aldi took on the fashionistas with ‘Aldi-Mania’, a branded clothing line paraded, cat-walk-style, down its middle aisle.

Aldi Admin ‘OOO’ – May 2022

Aldi cheekily called on other brands to ‘cover’ for them over a bank holiday.

‘Aldidas’ – November 2022

Aldi launched a sportwear range rather like another one.

Aldi-Mania Summer – July 2023

Aldi’s range of summer supersized summer swag.

Oldi-Mania – November 2023

Aldi range of iconic Christmas jumpers.

#Fake Moss – December 2023

Aldi heard that Kate Moss was coming to Fashion Week in Manchester.

They got their own Kate Moss look-a-like to capture content in a nearby Aldi.

Strategy

Breakthrough Thinking:

They asked themselves:

“What would motivate pre-family shoppers to interact with or follow a supermarket on social media?”.

Research revealed that 38% of people claimed to use social media to find funny or entertaining content, not the ‘food porn’, recipes and deals most supermarkets were sharing.

So, Aldi defined a clear way forward:

Do the most witty, unexpected thing on social that only a ‘pirate’ would do - to beat the ‘Navy’ of the other big supermarkets.

Their Strategy in a ‘tweet’ was:

Use disruptive humour and behaviour to earn attention and footfall.

Aldi ‘weaponised’ humour on social with a clear set of principles:

• Disrupt and Entertain

• Have a distinct TOV

• Be relevant within cultural moments

• Take provocative positions

• Develop deeper connections

• Define the right channel

Description

Background & Context:

Prior to 2021 the majority of Aldi’s social content had very few highlight moments. Looking back there were two campaigns that had gained significant traction.

- 30th Birthday campaign, ‘No-one Cares’ was disruptively honest, baiting competitors on social media into joining Aldi’s party.

- ‘Barking with BrewDog’ provoked the cult brewer to sell its wares on Aldi shelves, in response to a look-a-like legal challenge.

These campaigns had several things in common.

- They were humorous, seeking to provoke a reaction and seemingly unconcerned with ‘normal’ corporate behaviour.

- They boldly invited conversation, aiming to entertain audiences, rather than directly pushing brand and product messages.

If Aldi were to be successful in social channels it would need more campaigns like these and less of the expected things everyone else was doing.

Creative Challenge:

A problem well-defined is a problem half-solved and Aldi’s breakthrough thinking came when they asked themselves the simple and disarmingly honest question:

“What would motivate pre-family shoppers to interact with or follow a supermarket on social media?”.

Research revealed that 38% of people claimed to use social media to find funny or entertaining content, not the ‘food porn’, recipes and deals most supermarkets were sharing.

So, Aldi defined a clear mantra to guide social creativity:

Do the most witty, unexpected thing on social that only a ‘pirate’ would do - to beat the stodgy ‘Navy’ of the other big supermarkets.

The Solution:

Aldi’s Strategy in a ‘tweet’ was:

Use disruptive humour and behaviour to earn attention and footfall.

This gave Aldi creative license to ‘weaponised’ humour on social within a set of clear guiding principles:

• Be Disruptive and Entertaining

• Have a distinctive TOV

• Be relevant within Cultural Moments

• Take provocative Positions

• Develop deeper Connections

• Define the right Channel/s

Aldi took a four-pronged approach to generating content:

1. Daily Reactive

2. Customer Engagement

3. Planned Reactive

4. Core Trading Messages

This continuous ‘pipeline’ approach ensured Aldi were present, and responsive to their loyal followers and able to seed their inimitable style of virile, engaging content boosting reach and engagement at key opportunities.

Execution: The Big Hits

#FreeCuthbert – April 2021

M&S initiated legal proceedings over a copy-caterpillar cake.

Aldi responded with humour, cheek, and self-deprecation.

Aldi-Mania – April 2021

Aldi took on the fashionistas with ‘Aldi-Mania’, a branded clothing line paraded, cat-walk-style, down its middle aisle.

Aldi Admin ‘OOO’ – May 2022

Aldi cheekily called on other brands to ‘cover’ for them over a bank holiday.

‘Aldidas’ – November 2022

Aldi launched a sportwear range rather like another one.

Aldi-Mania Summer – July 2023

Aldi’s range of summer supersized summer swag.

Oldi-Mania – November 2023

Aldi range of iconic Christmas jumpers.

#Fake Moss – December 2023

Aldi heard that Kate Moss was coming to Fashion Week in Manchester.

They got their own Kate Moss look-a-like to capture content in a nearby Aldi.

Outcome

Combined reach grew from 449 million to 740 million, 2020-2023 - a +64.92% rise, while engagements grew 53 million to 102 million - a dramatic +91.23%.

Aldi’s pirate approach has undoubtedly contributed to impressive buzz scores - up to +218% vs. the UK grocery ‘Big4’, while frenzied media reactions also helped drive fame, peaks in Aldi’s SoS displayed a strong correlation with social campaigns.

SoS rises led market share, growing from a pandemic low of 4.39% to reach almost 12% post #FreeCuthbert and #FakeMoss.

Pre-pandemic penetration recovered by 2022 and continued to grow - Moreso with the pre-family social target audience, reaching 51% by January 2024.

Econometric data shows social campaigns have driven a combined incremental net profit of almost £42 million, delivering increased annual ROMI, reaching 610% in 2023.

The ‘Return on Likes’ really works.

Similar Campaigns

6 items