Cannes Lions

ELECTRONIC SECURITIES EXCHANGE

FALLON MINNEAPOLIS / ARCHIPELAGO / 2002

Awards:

Overview

Entries

Credits

OVERVIEW

Description

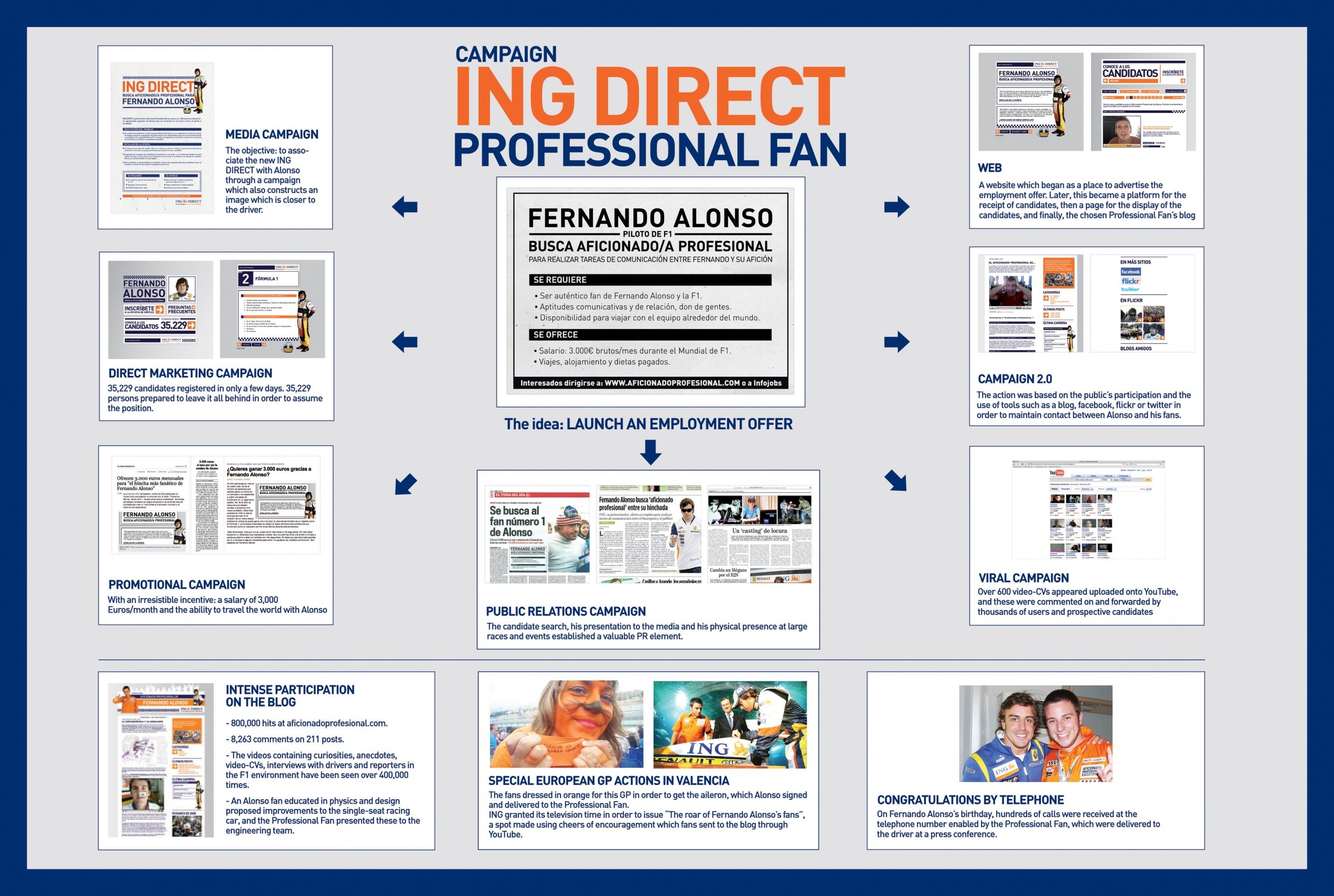

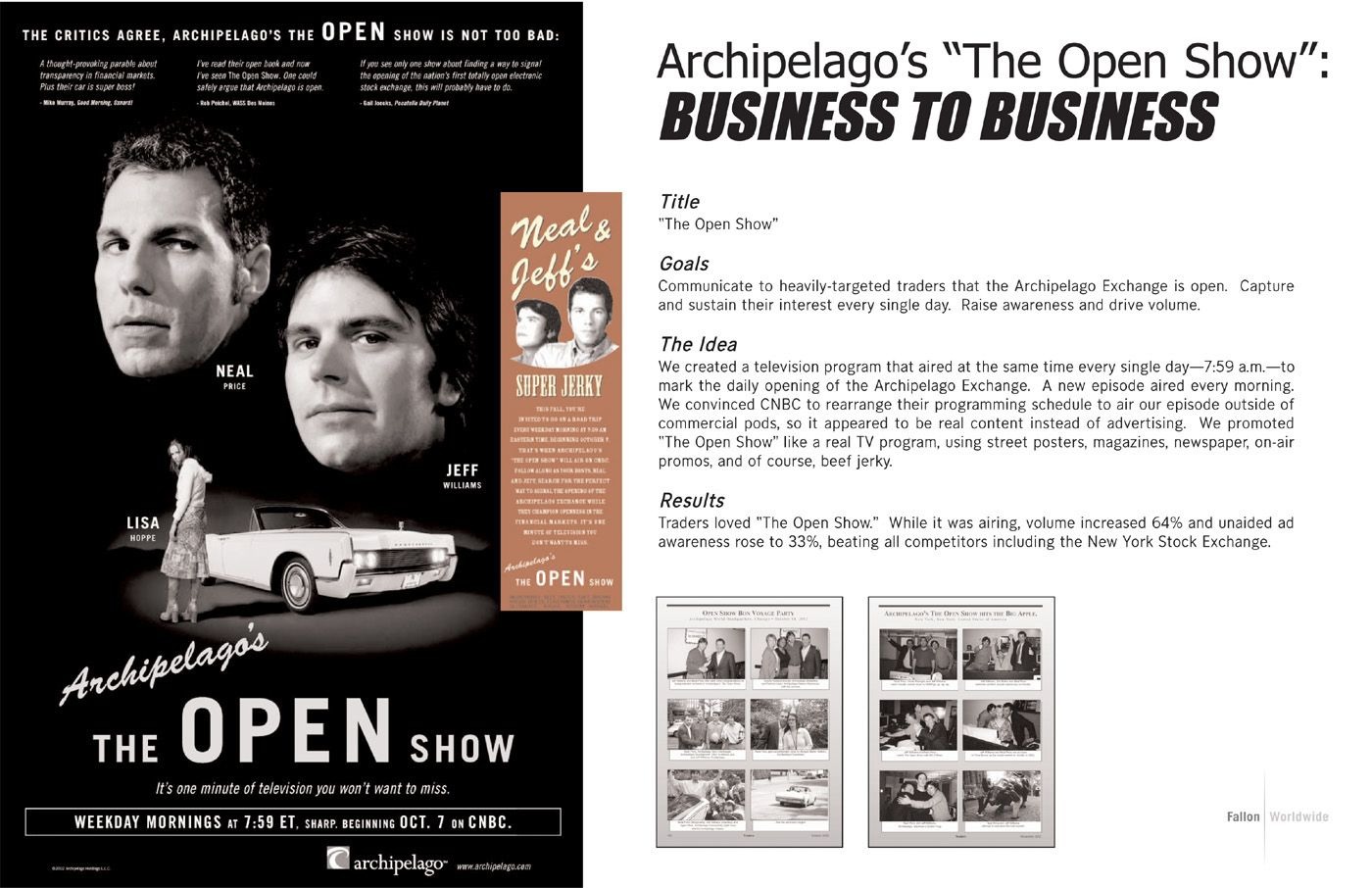

Alan Leusink/DesignerScott Vincent/Creative HeadJerrold Freitag/Account PlannerDavid Sigel/Group Account DirectorKaren Palmer/Account DirectorEric Hanson/Account Executive We had four goals: increase order volume and market share; drive people to Archipelago’s website; increase receptivity to sales calls; create buzz within the trading community.This is the story of a scrappy B-to-B company that competes with the icons of the industry (NYSE, NASDAQ). Founded in 1997, Archipelago is a tool for professional stock traders to electronically execute trades. Archipelago’s competitors employ middlemen known as “specialists” to match orders for traders. These middlemen have the privilege of near-complete knowledge of the supply and demand for a particular stock, plus they are allowed to trade on their own behalf. But with Archipelago, every trader has access to the same market information, and Archipelago never trades on its own behalf.

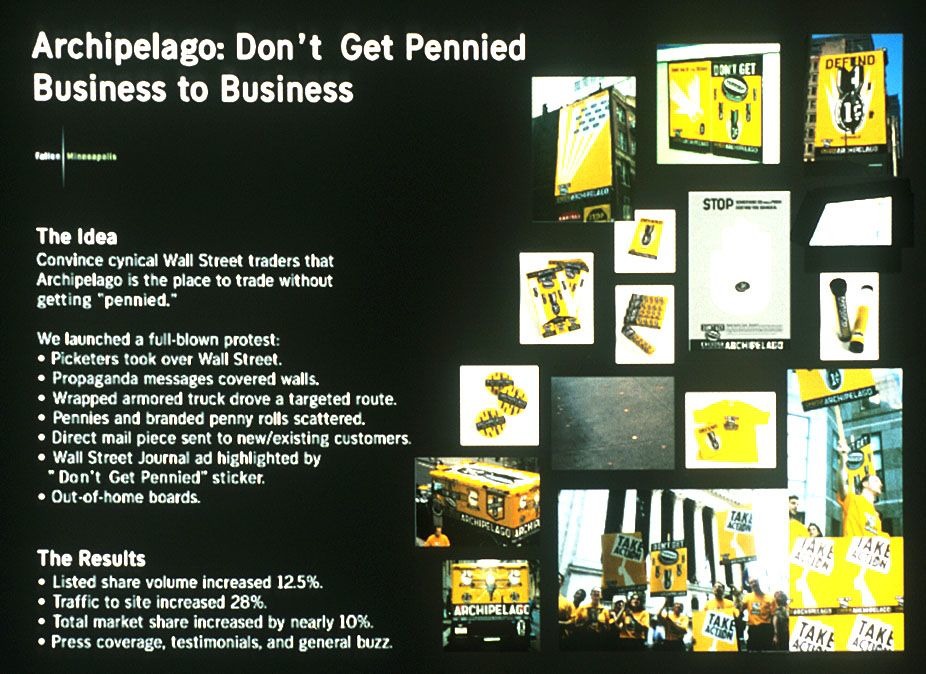

Last year, U.S. stock markets stopped trading in one-sixteenth increments and adopted a decimal system; stocks would now increase and decrease by one penny instead of six pennies. While the change benefited investors in many ways, it had one nasty side effect: it gave middlemen a big advantage over other market participants. Using inside information, middlemen were now able to “step in front of” existing orders and outbid them by just a penny. (Think of it as a silent auction where one bidder knows what every other bidder is going to offer—they have the ability to outbid every time.) The stock trading community grew irate as middlemen became richer at the expense of traders. This tension in the marketplace created a unique opportunity for Archipelago to spread the word about its offering: we presented Archipelago as the place to trade without getting “pennied.”Our target was professional stock traders. We studied them the way Margaret Mead studied Samoans: from where they live, work and eat, to what they read and think to how they spend their free time. They are the hyperactive Wall Street type—long hours and a short attention span. They are a competitive, capitalist, male, work-hard/play-hard, fraternal group. We faced the challenge of breaking through to this tough audience in an equally tough, cluttered physical environment: Wall Street.For the cost of what our competitors spend on a national ad in the Wall Street Journal, we launched a full-blown protest. This was a guerilla campaign aimed at exploiting a short-term opportunity. Our messages and vehicles were rallying cries, and like any good activist, we took to the streets to get our target talking. Because of the geographic concentration of the industry, we were able to focus our efforts in New York City and Boston and still see national results. Armed with first-hand knowledge of our target and detailed maps of customer and prospect firm locations, we set to work selecting street corners and subway stops to canvass. Teams of demonstrators, complete with picket signs, marched along carefully planned routes between target offices and commuter stations in Manhattan and Boston, picketing, chanting and handing out “Don’t Get Pennied” sticker sheets and branded penny rolls. A wrapped armored truck drove a targeted route through the financial districts of New York and Boston. Pennies and branded penny rolls were scattered in high-target-traffic locations. A direct mail piece containing a campaign poster, a branded roll of pennies, a sticker sheet and a button was sent to current and potential customers. A full-page ad ran in two Wall Street Journal regions; we handed out free copies with “Don’t Get Pennied” stickers on the front page at hand-picked locations in Wall Street. Three walls in downtown Manhattan were covered by large wallscapes, and two additional walls were covered with Penny propaganda posters. Dozens of out-of-home boards in high-target-traffic Boston subway stations caught morning and afternoon commuters. From conception to implementation, our media team led this program, collaborating with creatives, account planning, designers and account people every step of the way. The media team flew to New York to submerge themselves in the life of a trader, from his or her morning commute to lunch to post-work dinner and drinks. Media’s depth of consumer understanding played a crucial role in facilitating and directing the development of creative ideas, strategy and media tactics. This campaign is a winner because it not only exceeded all the business objectives, but once again placed Archipelago at the center of a cultural movement within the securities industry. Archipelago’s listed share volume increased 12.5%, their total market share increased by nearly 10%, and unique-visitor traffic to their site increased by 28%. We received numerous press mentions and achieved tremendous buzz among our target. “I went on customer calls at the American Stock Exchange that week and noticed a trader wearing the ‘Don’t Get Pennied’…stickers all over his jacket,” said one Arca sales rep. “I have a demo…with a…broker/dealer that called us as a result of seeing the penny campaign on Park Avenue today,” said another Arca sales rep. Perhaps no audience is as cynical, as hard-core, and as seemingly impervious to targeted marketing as the Wall Street trader, and yet we were able to connect with them and advance the Archipelago brand in a meaningful way.

Execution

From conception to implementation, our media team led this program, collaborating with creatives, account planning, designers and account people every step of the way. The media team flew to New York to submerge themselves in the life of a trader, from his or her morning commute to lunch to post-work dinner and drinks. Media’s depth of consumer understanding played a crucial role in facilitating and directing the development of creative ideas, strategy and media tactics.

Similar Campaigns

12 items