Dubai Lynx

Faces Of Fraud

WUNDERMAN THOMPSON, Dubai / HSBC / 2023

Overview

Entries

Credits

OVERVIEW

Background

Operating in the shadows,fraudsters steal trillions of dollars every year.Hiding behind their anonymity, these sophisticated criminals constantly invent new ways of manipulating people.

Because fraudsters can masquerade as anything from a bank text to a romantic interest on a dating app to an investment website, consumers are constantly vulnerable, but may underestimate the risk.

Scammers manipulate victims into ‘hot states’ making them panic into giving away crucial personal details. To make things worse, many fraud victims feel so much shame,they don’t share their experiences, fueling the cycle of ignorance.

While there is awareness about fraud,there’s limited effective guidance on how to really avoid one. And as fraud methods are evolving,fraud communication needed to evolve with it.

HSBC wanted to take some of the power away from these faceless criminals & create a memorable educational tool that helps people spot the tell-tale signs of fraud & open up an honest conversation.

Idea

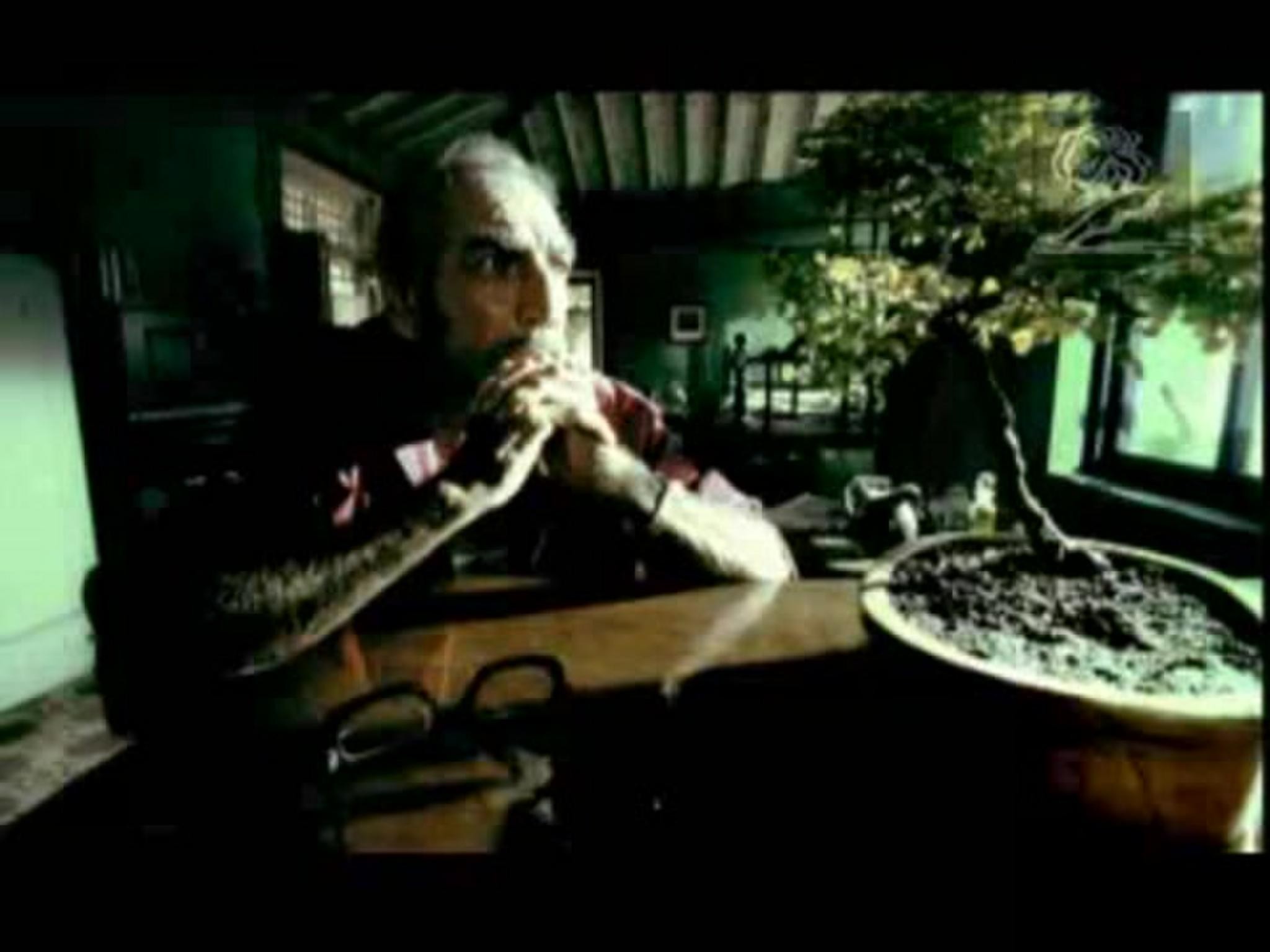

Hiding behind their anonymity, fraudsters can pretend to be anyone or anything.

What if we could unmask them and have them teach us their tricks?

We used an AI that predicts a fraudster’s face by analysing their voice recordings. Each voice has a unique fingerprint or audible DNA, that correlates to facial features like size of jaw or shape of nose.

For our campaign, we used actual recordings of fraudsters from scam calls and recreated their faces using AI. These digital reconstructions were brought to life in a series of tutorials that educated the public on how to spot their dirty tactics, finally putting a face to a faceless crime.

From romance scams to bank impersonations, our digital fraudsters are now helping the public, rather than stealing from them.

Strategy

Studies show that global payment fraud has more than tripled in the last decade, from $9.8B to $32.4B between 2011 and 2021. These numbers are forecasted to only increase, with card fraud expected to cost the financial industry $400+ billion in global losses.

Further data showed that 95% of fraud and cybersecurity breaches are caused by human error, and 55% of people believed lack of understanding on how a fraud works was the key reason why people fell for them.

In addition, the fraud landscape has changed & scammers are capitalising on the explosive growth of digital-based services.

But as fraud is a faceless crime, people believe that it won’t happen to them. Our strategy was to make this crime concrete, to help people better understand what they are up against & give a tangible face to these scam artists who operate in the shadows.

Execution

We worked with Carnegie Mellon University and fed voice recordings of real fraudsters into a ‘voice to face’ AI. Face composites were generated based on the speaker’s unique ‘audible DNA’, identifying facial characteristics such the shape of jaw or size of nose. Age, gender, ethnicity, weight can also be reasonably predicted.

We then partnered with Epic Games & used their ‘Unreal Engine’ 3D digital technology to create our MetaHuman fraudsters based on this biometric data from the AI before bringing them to life through motion capture.

These digital fraudsters became HSBC’s fraud prevention teachers, at the center of a 360 campaign in which they share their techniques to manipulate victims & outline how common scams work –on dating apps, texts, and many other platforms. So now, instead of hiding in the dark & stealing from people,fraudsters show their faces to educate the public on how they can avoid future scams.

Outcome

The campaign has shown the faces of fraud to millions of people.

Reached a total of +3M people, +10M impressions, +10k clicks. It achieved +2.8M views surpassing our planned views within 2 weeks of a 6-week campaign period:

- On TikTok, the campaign achieved the total view target in the first week spending just 27% of the budget. It recorded a very a high view through rate of 32.2% on TikTok exceeding benchmarks by more than 2 times

- On YouTube, it achieved view through rate of 66.54% vs a benchmark of 35%

- View throughs have also surpassed all of benchmarks too on FB and Insta

Most importantly, through a technically cutting edge campaign, HSBC became the first bank to shift the battle ground and to give customers the upper hand, by pulling fraudsters out from the dark instead of just asking customers to blindly defend themselves.

Similar Campaigns

12 items