Cannes Lions

Inclusive by Design

McCANN XBC, New York / MASTERCARD / 2024

Awards:

Overview

Entries

Credits

Overview

Background

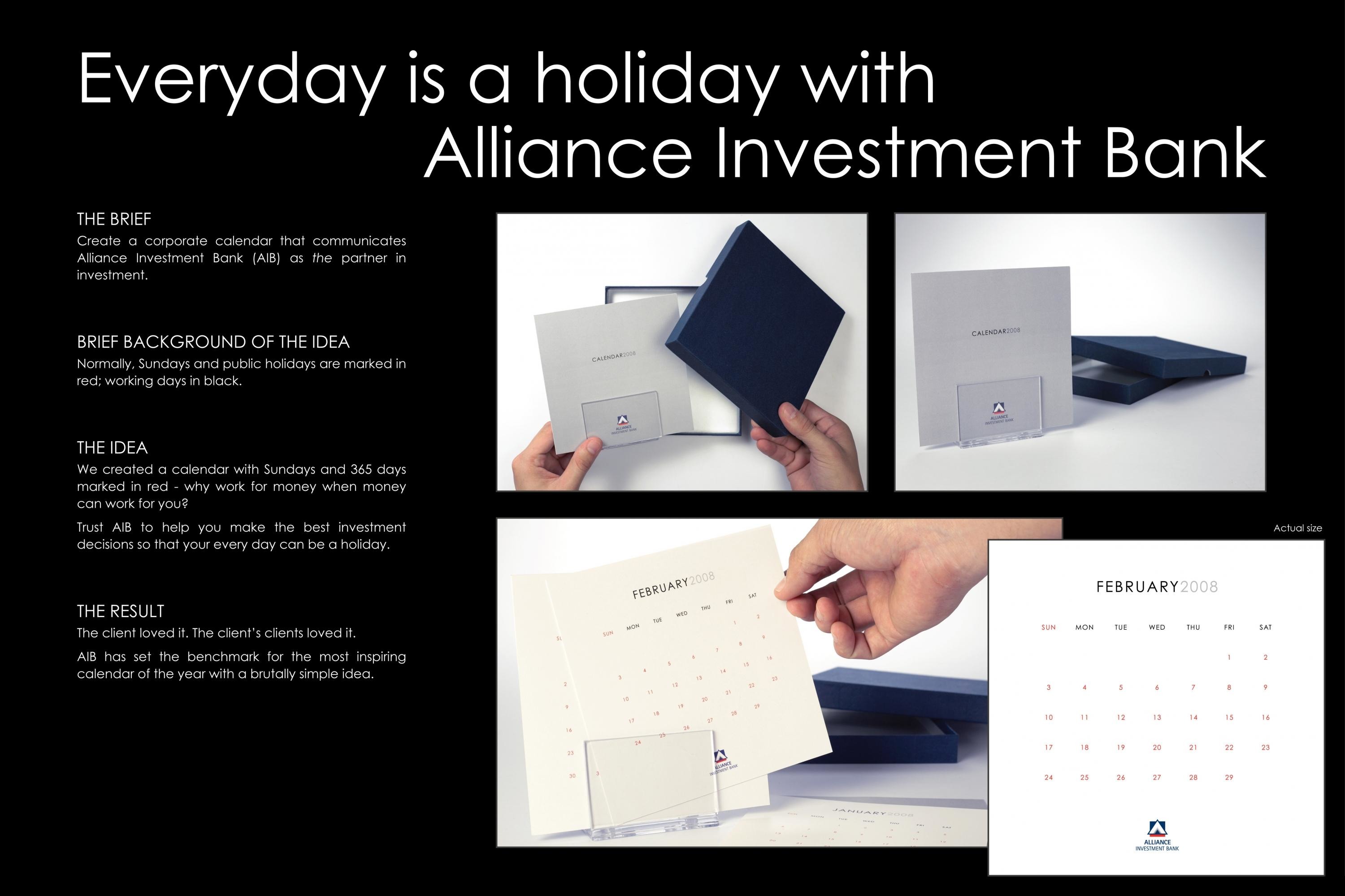

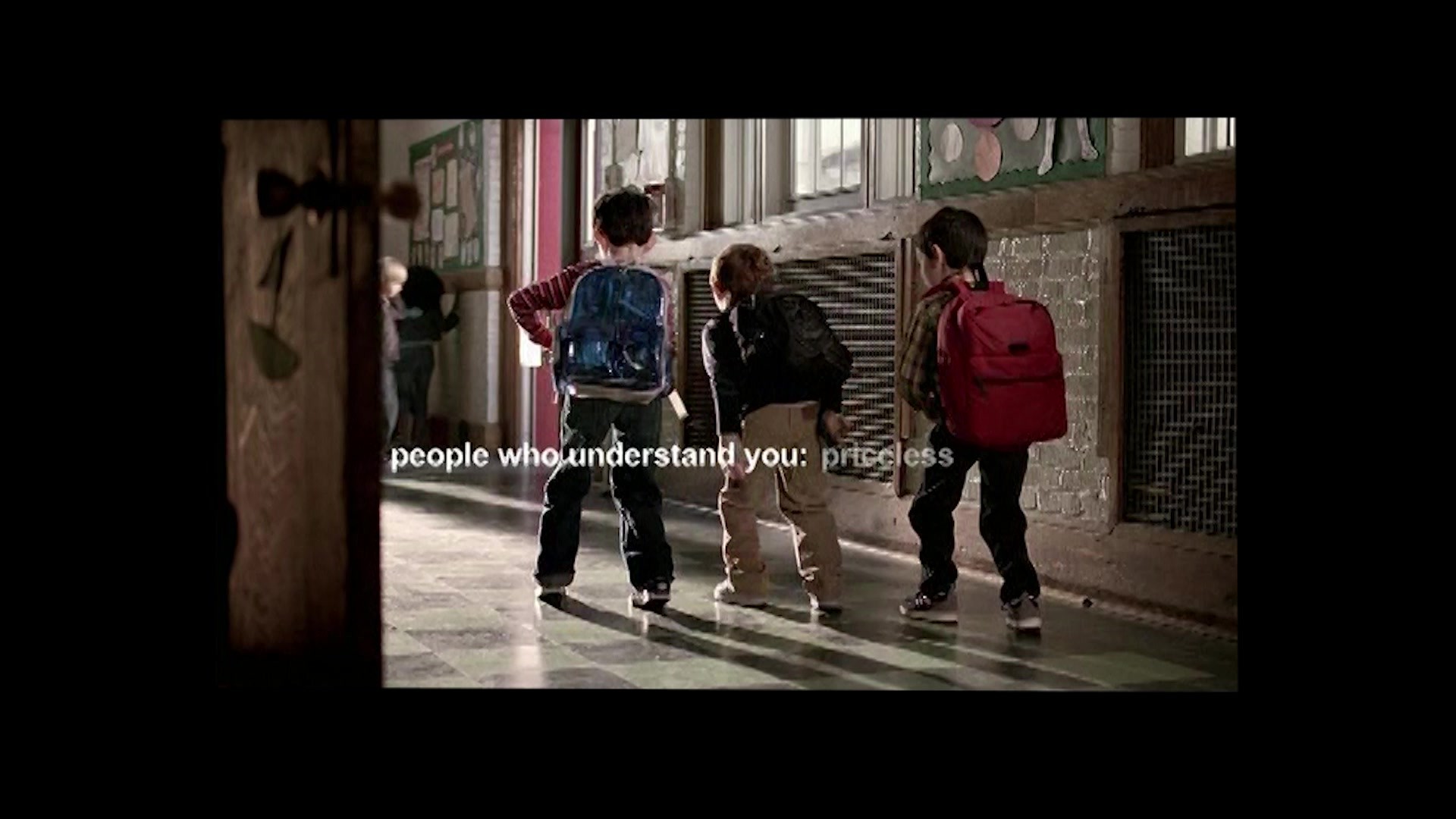

In 1997, McCann and Mastercard presented the public with a powerful idea in the financial space: Priceless. In a world that was indulging in conspicuous consumption through a card swipe, Mastercard championed the idea that what really matters were the things money couldn’t buy. This singular stance on consumption gave Mastercard a competitive advantage and won them business in the market.

Fast forward two decades: the economy had increasingly shifted into a digital reality. Leaps in technology promised a better life yet Priceless remained out of reach for too many around the world:

1.4 billion people globally are excluded from the financial system.

As a result countless marginalized communities faced discrimination, exploitation, endless barriers blocking their way to better future.

For Mastercard to continue building equity in Priceless, they had to move beyond a commentary on consumption to applying their innovation towards solutions and actions that meaningfully advance financial inclusion.

Idea

The creative ideas all aimed to unlock a priceless action that drove inclusion:

For the transgender community, we took on long-standing regulations and infrastructure to create True Name, enabling people to use their chosen names.

For the partially-sighted, we innovated on design and entrenched processes to create Touch Card, allowing anyone to tell cards apart with a touch.

For dementia patients, we simplified a UX riddled with legal barriers to create Sibstar - an app and card that let caregivers manage loved ones' spend.

For Ukrainian refugees fleeing to Poland during the Russia-Ukraine war, our “Where to Settle” platform aggregated data sources to direct users to the best places to settle in Poland based on their personal conditions.

As newly settled Ukranian entrepreneurs were positioned as a competitive threat to local businesses in Poland, we built the Where to Start platform which used our data to pinpoint synergies between complementary businesses (e.g. bakeries moving next to hair dressers).

Our campaign Room for Everyone shed light on how new businesses opened by Ukranian migrants could be beneficial to existing, local businesses across Poland.

Strategy

We used quant research and interviews with marginalized communities. We turned to experts in accessibility – LGBTQIA+ advocacy organization GLAAD, The Royal National Institute of Blind People,, the Alzheimer’s Society and the Polish government agencies helping Ukrainian refugees to understand deep-seated problems plaguing these communities.

Problems like:

• Credit card security protocols forcing transgender and non-binary people to use their birth names against their will.

• Partially-sighted people unable to distinguish between credit cards due to ubiquitous design.

• Legal hurdles blocking the way of caregivers in helping those with dementia manage their finances.

• Ukrainian refugees first abandoned in Poland with no guidance on how to rebuild new lives and then, post settling in, faced growing greater opposition from locals on the basis of unwanted competition.

Breakthrough Moment:

All these challenges had been accepted as “unsolvable,” within the traditional system, but acting as an engine of inclusion, we uncovered innovative ways to bring together our network, technology, and partnerships to create new solutions.

Description

For Mastercard, financial inclusion isn’t just an altruistic imperative; its core to business strategy. The more people who have access to economic opportunity, the better for them, the world, and for Mastercard.

We examined communities being excluded from the financial system and ideated creative ways to deploy our core capabilities, network and partnerships to break down the barriers.

Though Mastercard had innovative solutions, we needed our B2B partners to buy in and bring our solutions to market. Mastercard doesn’t sell solutions directly to consumers—their B2B partners do. Without them on board, our ideas would remain simply innovative prototypes instead of real solutions that real consumers could use.

Rather than viewing this as an obstacle, we saw it as an opportunity to deepen relationships with our B2B partners by working together and sharing the credit.

Our creative work always had two components:

1. Mastercard innovation solution aimed at solving a financial barrier plaguing a marginalized community.

2. Creative communications to spark awareness, support, consideration, and buy-in from B2B partners.

To understand where we were most needed, we used quantitative and qualitative research to connect directly with marginalized communities and experts in accessibility from the LGBTQIA+ community, The Royal National Institute of Blind People, VISIONS/Services for the Blind and Visually Impaired, the Alzheimer’s Society, even Polish government agencies helping resettle Ukrainian refugees.

We uncovered structural issues riddling the financial system, barring these communities from thriving.

Issues like:

• Credit card security protocols currently forcing transgender and non-binary people to use their birth names against their will.

• Credit card design being impossible for partially-sighted people to distinguish by touch.

• Credit card bill management systems that were too complex for people with dementia and legal systems that prevented their loved ones from helping them.

• Inadequate and disconnected guidance for Ukrainian refugees on where to best rebuild new lives after being forced out of their home country.

Once we identified clear problems, we pulled together innovation teams, engaged regulators and business partners to bring these solutions to life.

We cut through red tape to create True Name for the transgender community - the first credit card people could use their chosen names.

We innovated on card design and the entire manufacturing and distribution process to bring to market the Touch Card for the partially-sighted, a card that used notches to allow anyone to tell their cards apart with a touch.

For dementia patients, we simplified a complex UX riddled with legal barriers. Sibstar was an app and card that let caregivers seamlessly put guardrails around their loved ones' spend.

And for Ukrainian refugees fleeing the Russia-Ukraine war, we built “Where to Settle.” A revolutionary app that aggregated the power of Mastercard’s and the Polish Central Statistical office's anonymized data, to direct users on where they should migrate in Poland based on their personal conditions.

Each innovation transformed us in the market from being an engine of consumption to becoming an engine of inclusion powered by innovation.

Outcome

Our creative strategy of centering our efforts around innovations that make Mastercard into an engine of inclusion has paid off:

Our work has provided powerful tailwinds for Mastercard’s brand vs. Visa:

• Socially-Conscious: +14pts

• Innovative: +16pts

• Visionary: +45pts

• Customer-Centric: +27pts

It’s grown brand and business:

• Mastercard’s revenue up 67% since 2018.

• Mastercard’s brand value up 56% since 2018.

• True Name: available to 900M people in 32 countries

• Touch Card: available to 200M people in 10 countries

• Sibstar: available to 67M people in UK, with more countries coming

And created a step change in greater financial inclusion:

- True Name inspired competitors to create similar products.

- Touch Card and Sibstar created new standards in accesiblity

- Where to Settle benefited ~20% of Ukrainian refugees in Poland.

- Up to 40% of new business owners used the Where to Strat platform and post campaign, 55% of Polish entrepreneurs reported Ukrainian entrepreneurs having a positive impact on the economy (a 10% lift from before).

Lasting impact for society and business? Now that's priceless.

Similar Campaigns

12 items