Cannes Lions

Meal Matrix

MEDIACOM, London / TESCO / 2019

Overview

Entries

Credits

OVERVIEW

Background

Easter is the second biggest national celebration in the UK, with billions at stake for supermarkets like Tesco. Industry cliché is to advertise lamb for Easter (the way turkey is for Christmas). However, Tesco suspected that Easter festivities are far less fixed than Christmas – verified after research showed that less than one fifth of families were tucking into lamb.

To outsmart the competition, who were still focusing on lamb, we set out to discover what other products our customers were turning to. We could then use this data to understand (and reflect) the UK’s food preferences at scale, make shoppers’ Easter meals personal and tempt their custom away from other big-name supermarkets, nudging as many as possible to local Tesco stores at this critical trading period.

Idea

Advertising lamb for Easter is an inaccurate industry stereotype, with the UK’s 26 million households choosing to celebrate in 26 million different ways.

In fact, only two in ten people choose lamb for Easter. Two choose beef, two choose chicken and the remainder favor other meat, fish or vegetarian choices. This also flexed regionally, so that lamb was still more popular in Wales but less so in London. Yet supermarkets hadn’t caught up. In recent years, all of Tesco’s competitors promoted lamb across print, TV and social media.

Seeing an opportunity to deliver growth and beat the competition, we decided to use data to understand (and reflect) the nation’s meat preferences at scale. This would allow us to still reach all category buyers but with a dynamically targeted message delivered to each – encouraging them to go to Tesco for offers tailored around their favorite Easter products.

Strategy

To understand Britain’s Easter shopping baskets, we analysed ten years of sales data – busting the industry myth that Easter equals lamb.

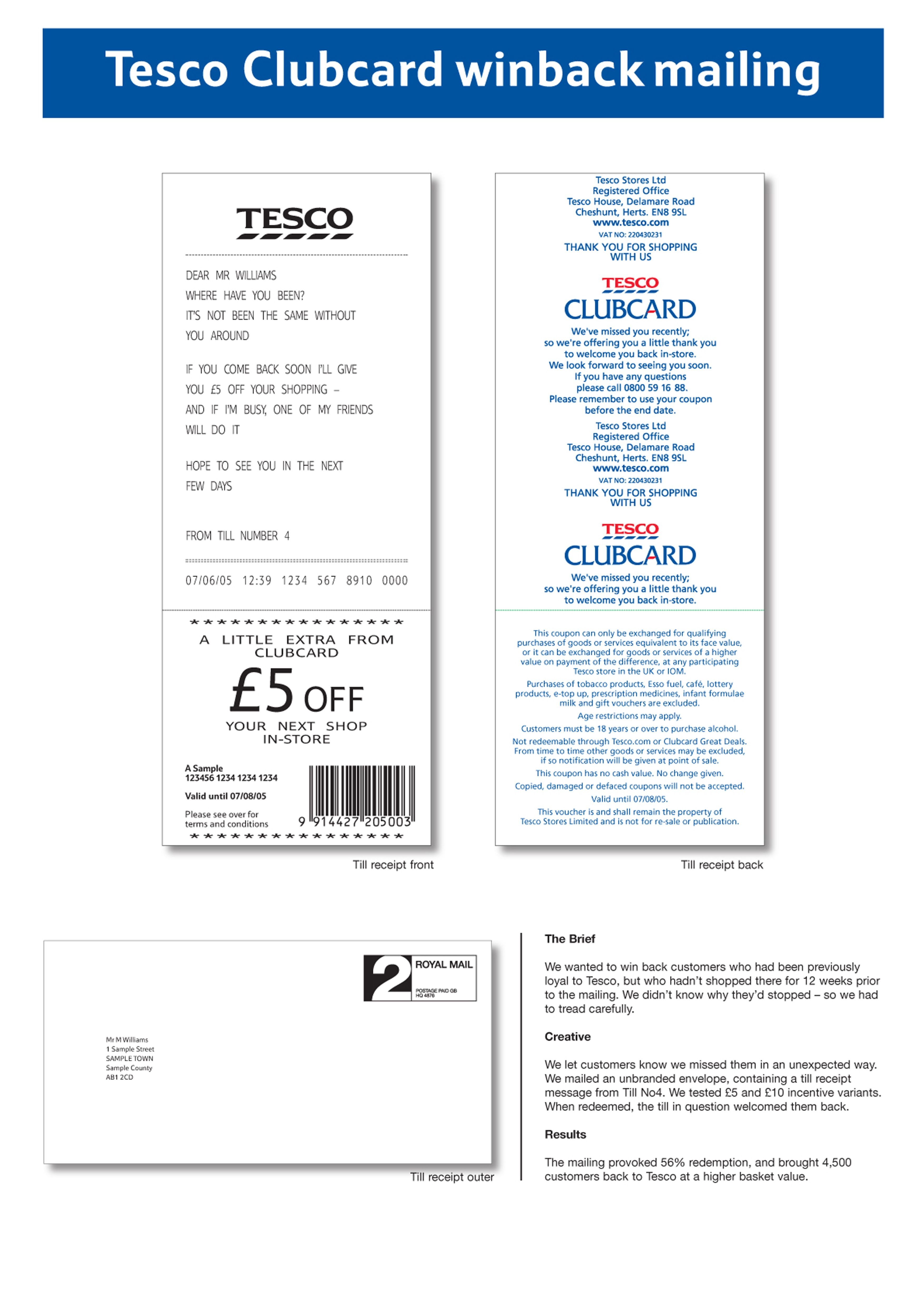

Sales data revealed that lamb made up just one fifth of total Easter meat sales. To uncover customers’ real Easter meat preferences, we used GlobalData and Kantar supermarket category data to create the ‘Meal Matrix’: a graph plotting the most commonly purchased Easter products against age and affluence.

This data revealed that ‘Easter = Lamb’ was a national average masking the real underlying pattern. Alternatives e.g. beef and salmon were each popular amongst a large sub-segment of the population. This pattern of real behavior was missed by supermarkets’ traditional Easter behavior. Understanding whether a given shopper preferred chicken, beef, salmon, lamb or vegetarian alternatives took us to a place where we could use data to identify and create actionable, scaled groups.

Execution

Via programmatic partnerships, we delivered the ‘Meal Matrix’ at scale, reaching category buyers nation-wide:

Firstly, we discovered what Tesco customers were buying, by using shopper data from Tesco’s website and loyalty card purchases. For non-Tesco customers, who lacked Tesco sales data, we used third-party data from data-driven media partners MiQ and Crimtan, including:

• Purchase data from Mastercard, Nielsen and Kantar

• Keyword data to infer quality preferences e.g. searches for luxury vs. value brands

• Social data from Crimtan revealed what recipes people were sharing online

The above also provided information on individuals’ regionality, meaning we could up-weight regions.

Now came ensuring customers received the right message! Online, we plugged data into programmatic buying partner Sociomantic, Facebook and Instagram. To reach value-seekers, we cherry-picked radio slots and tabloid newspapers. To reach quality-seekers, Tesco Finest products appeared in broadsheet newspapers. Data was also used to amend messaging to vegetarians/pregnant women.

Outcome

Overall, the ‘Meal Matrix’ served 90 million impressions from Tesco’s Easter range - helping Tesco's objective to win 2018 Easter sales.

By planning a campaign at the intersection of planning worldviews, we proved brands don’t need to choose between targeted communications and reaching all category buyers.

Using data to uncover more complex behavioural patterns allowed us to reach all category buyers, segment them into meaningful groups, and target them based on individual behaviours – and all with a fifth less budget year-on-year:

• Tesco Easter sales were up 6.1% YoY

• The ‘Meal Matrix’ campaign was directly successful at driving household penetration (+1%), purchase frequency (+2%) and spend per household (+3%)

• Tesco’s market share during the Easter period rose to 43%, 14 percentage points higher than their average share in market

• Tesco beat every grocer to the number 1 spot during supermarkets' second biggest trading period

Similar Campaigns

12 items