Cannes Lions

The Jarnys

BBDO NORDICS, Malmo / E.ON / 2024

Overview

Entries

Credits

OVERVIEW

Background

Background:

In 2022, Sweden and Europe were thrown into the biggest energy crisis in 50 years. Turn of 2022/2023 there was a real threat to power shortages in Sweden’s electricity grid, and volatile prices made people worried and angry. As the largest player in Sweden's most expensive energy region, E.ON was right in the firing line. Suddenly everyone was interested in energy prices, but the understanding of the energy system was very low. The blame game arrived quickly, and the brand took a real beating.

Brief:

Let people know that E.ON understands their consumers situation and have a sustainable solution in lowering energy consumption with the product ELNA.

Objectives:

1. Increase in Brand Index. 2. Make people lower their energy consumption, to prevent power shortages in the grid. 3. Drive awareness and sales of E.ON ElnaTM.

Idea

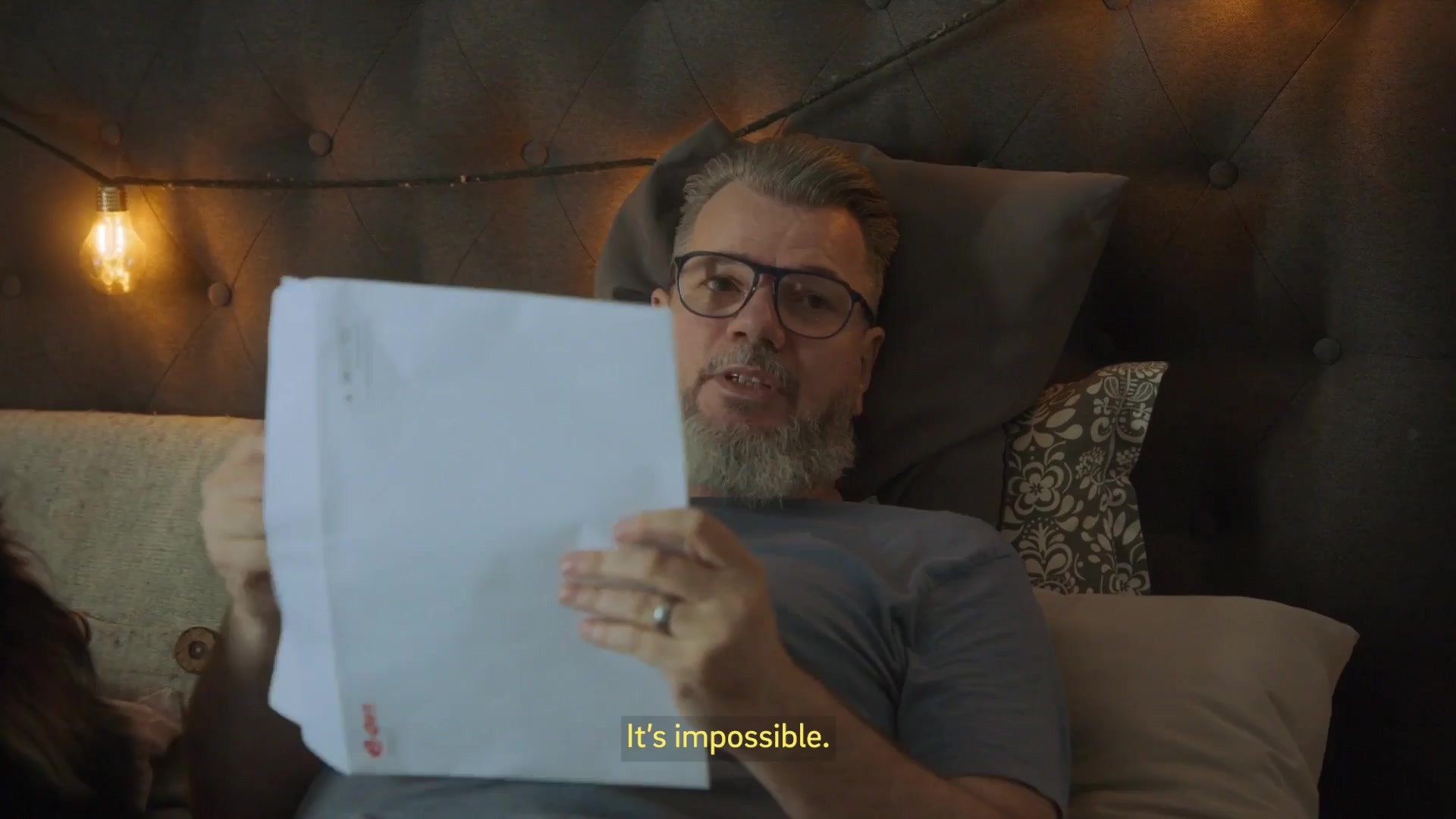

We transformed the everyday life of an ordinary (well…) family into a reality show on YouTube, and a 100% authentic energy experiment. Meet The Jarnys – a family of nine heavy energy consumers living in a house with screens in every room, mini fridges, popcorn makers, hot dog machines and Papa Jarnys fully equipped DJ garage. And more.

Their task is quite straightforward: they must lower their electricity consumption. Each episode revolves around an energy saving mission to solve. To help them, they got the smart app service E.ON Elna, which gives a precise overview of the energy consumption in real time. The main character, “Papa Jarny”, often struggles to get the rest of the family onboard the missions. Which is quite logical since they all love electricity gadgets, long hot showers, and a well-heated house. So, if this family can lower their energy consumption, any family can!

Strategy

Strategic process: We needed to find out:

1. Immediate consumer needs and how E.ON were lacking to fulfill these (Data:

Customer satisfaction (sNPS), consumer segmentation and strategic positioning

models (Odyssey), BrandTracker (YouGov))

2. The main trust factors. (YouGov)

We found an increased worry for affordability and price and capacity issues were main

trust factors. Attitudes towards sustainability were stable, but not primary reason for

choosing.

We also found positives; electrification as a trend and adaptation to new technique

and digitalisation was growing.

The breakthrough moment came when we realized that we might be able to reverse

the negative brand trend and improve attitude towards; if we can help consumers

lower their energy consumption and save money. E.ON had the technique to do this, if

we could break through the negative sentiment and find a way for people to listen.

Execution

First of all: Our creative decisions were all about warmth, authenticity and entertainment. And when choosing production company, we chose one specializing on reality documentary, instead of advertising, to create something unnormal from something very normal. The first episode was released on October 31, 2022. A well-planned timing, since it’s usually getting colder in Sweden from Oct/Nov, leading to bigger electricity bills. In parallel with this, we talked to journalists and got our story into earned media, including Sydsvenskan, the largest morning newspaper in southern Sweden, where E.ON is the largest player. We then released a new episode every other month, until the summer/autumn 2023. The full episodes were published on YouTube, where we also bought pre-rolls and trueviews. On Meta, we published 15s trailers and short nuggets to get extra reach as well as engagement.

Outcome

#70% average view rate, 30% completion rate on full episodes (+6min long).

#+3 million views over 30s (total market in Sweden: 10M people… driving E.ON's spontaneous #Ad Awareness to an11,4% average in 2023, the highest (and most stable) level in 4 years.

#20 864 705 minutes of content watched (including short formats)

#Increased Brand Index, from +3.4 to +5.7, outperforming all competitors without increased spending (which is about half of our main competitor Vattenfall).

#Reduction of energy consumption 2023 vs 2022 (private consumers/small businesses): National average, 1,7% / E.ON's customers 8%. A reduction that also correlates with a higher Ad Awareness among E.ON's customers (11% vs 31%).

#+43% in sales of E.ON Elna compared to target

#For the first time ever, E.ON’s market share exceeds main competitor Vattenfall’s.

Oct 2022–Oct 2023, E.ON had the strongest growth, all categories (Resumé/Xtreme Insights).

Similar Campaigns

6 items