Cannes Lions

GETIN POINT

GETIN NOBLE BANK , Warsaw / GETIN NOBLE BANK / 2014

Overview

Entries

Credits

Overview

Description

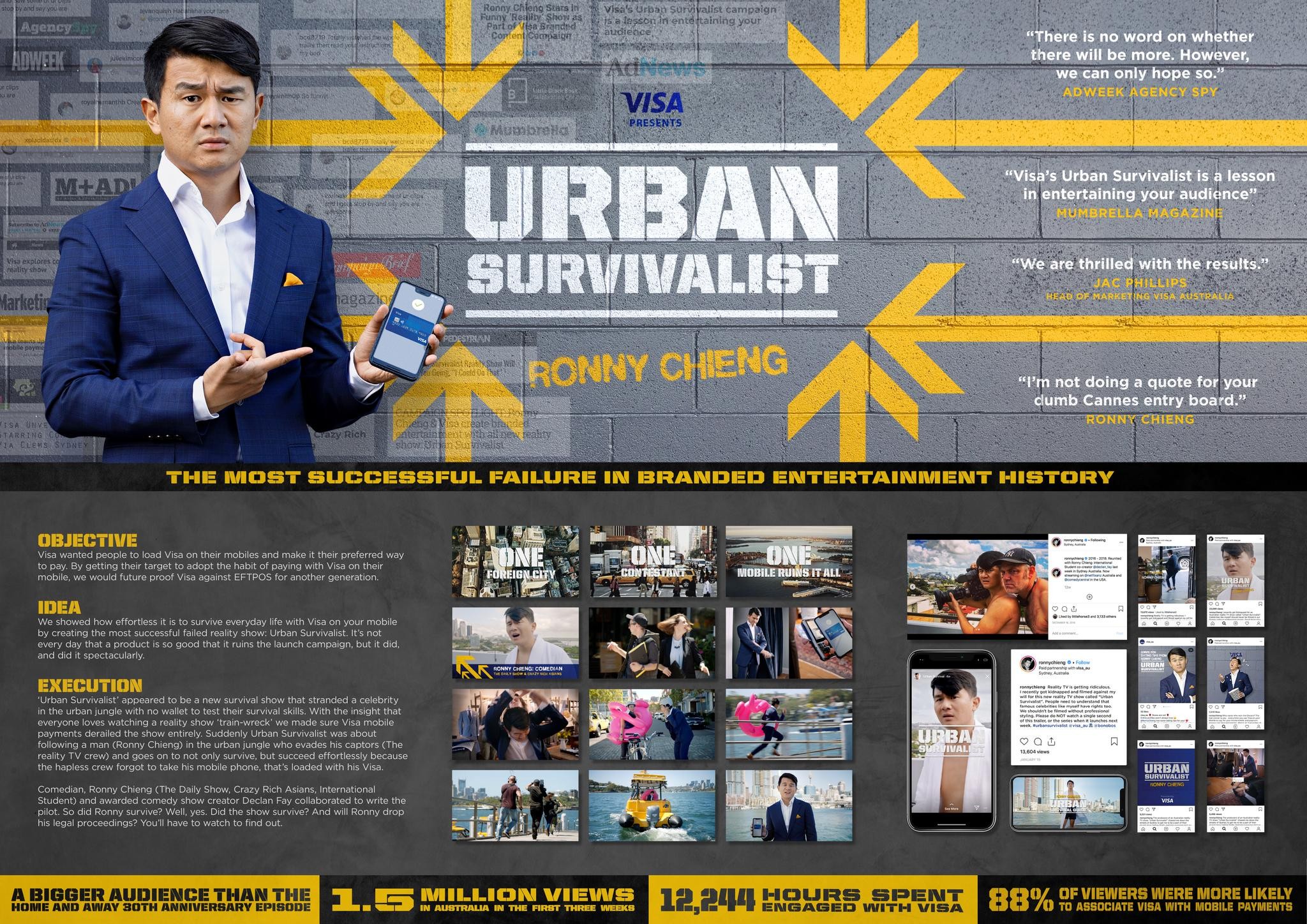

There are several reasons why we need to visit a regular bank branch every now and then, e.g. signing an agreement or changing personal information. Most often, however, they’re connected with the need of identifying a client, verifying that one John Smith is in fact John Smith. It is the so called sensitive data, which must be verified by bank employees.

We’ve decided to take over the duties of a regular branch by the machine and open self-service branch, where Clients can deal with all the issues which, until now, could only be dealt with in the regular branches.

Execution

There are several reasons why we need to visit a regular bank branch every now and then, e.g. setting up an account, signing an agreement, submitting specimen signature or changing personal information. Most often, however, they’re connected with the need of identifying a client, verifying that one John Smith is in fact John Smith, that the ID card he holds really belongs to him or that the signature he uses is his. It is the so called sensitive data, which must be verified by bank employees.

To take over the duties of a regular branch successfully, Getin Point needed a functionality to identify the Client. To that end, we’ve mounted two cameras, which enable consultants to verify the Client’s identity, a special ID card scanner, thanks to which we can check authenticity of the document, and a screen on which the Client submits his specimen signature to be filed and stored in the system. There’s also a reader using finger vein biometrics, which enables the Client’s identification during any subsequent visit to a Getin Point. This reader uses the finger’s unique vascular structure, and this technology considerably speeds up the service and security of transactions. The combination of the above mentioned elements has given us the ability to fully and safely verify the Client’s identity and, as a result, has enabled the Clients to do many operations themselves, which, up to that point, were restricted to regular branches only.

Getin Point provides support for cash, payment of bills, setting up deposits, making transfers from the account, as well as setting up new accounts and instant issuance of payment cards. Moreover, clients can apply for a new product, change the signature pattern eg after getting married or change the ID card when the old has expired.

Outcome

In the two months since the project implementation, we've set up 7 Getin Points. They were

visited by 2000 customers who set up over 150 current accounts. They are all new Clients to the

bank, who, during only one visit, were able to set up an account and have a payment card

issues on the spot, so that they could use the account right away.

For now, we're planning to expand the Getin Points system in shopping centres only, but the

mobility of this solutions allows us to place them practically anywhere.

Similar Campaigns

11 items