Creative Business Transformation > Business Design & Operations

INCLUSIVE BY DESIGN

McCANN XBC, New York / MASTERCARD / 2024

Overview

Credits

Overview

Please provide any cultural context that would help the Jury understand any cultural, national or regional nuances applicable to this work.

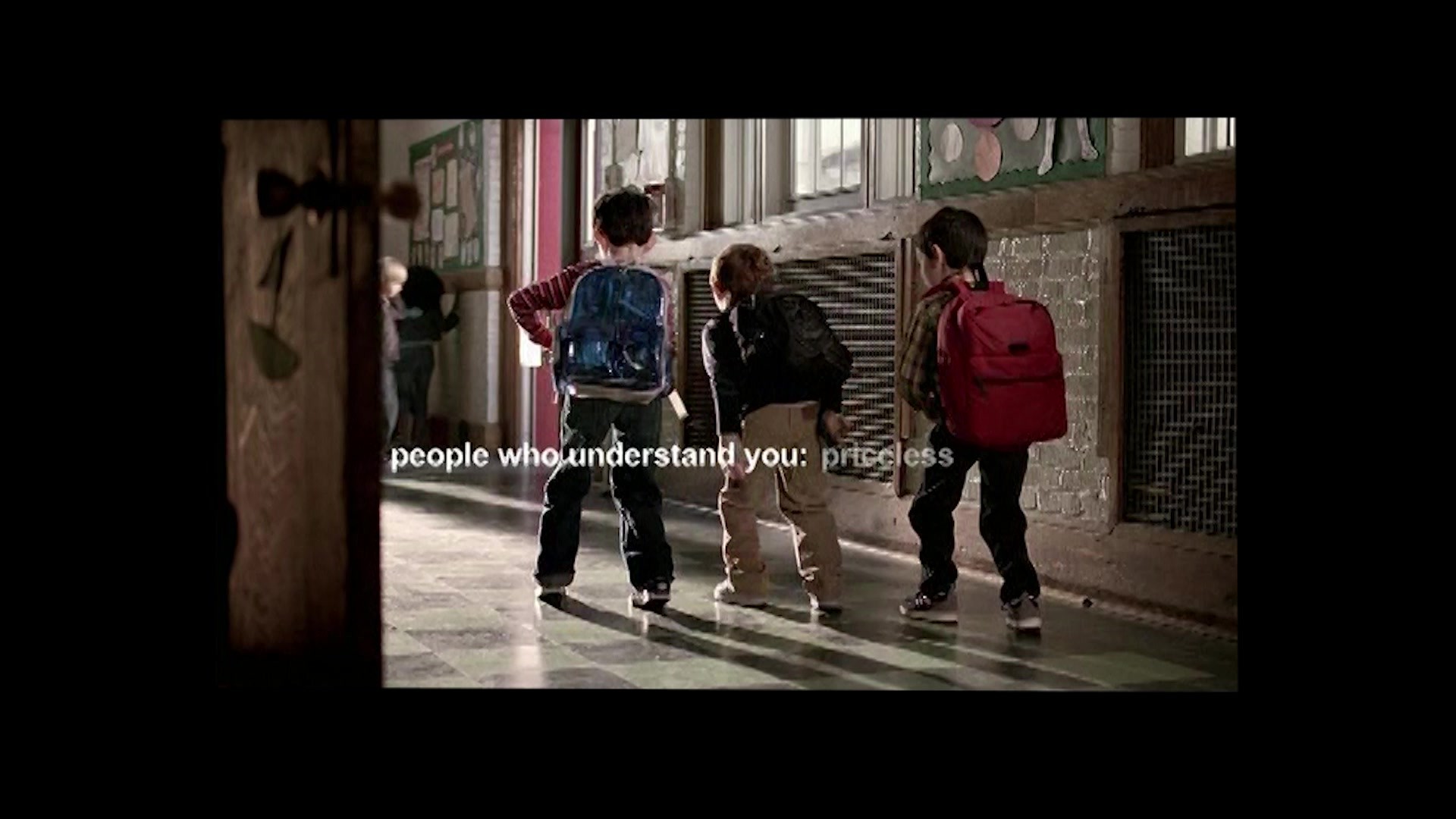

In 1997 our company and Mastercard presented the public with a powerful idea in the financial space: Priceless. In a world that was indulging in conspicuous consumption through a card swipe, Mastercard championed the idea that what really matters were the things money couldn’t buy.

It was this stance on consumption that has differentiated Mastercard from its key competitors - Visa, Amex, Discover - companies who offered the same tech with the same promises of speed, convenience and ease.

Fast forward two decades: the economy had increasingly shifted into a digital reality. Leaps in technology promised a better life for all yet Priceless remained elusive to far too many people.

Within the financial category, a glaring inequity stared everyone in the face: 1.4 billion people globally are excluded from the financial system. As a result countless marginalized communities faced discrimination, exploitation, and endless barriers blocking their way to opportunity and better futures.

To truly pay off Mastercard’s promise of Priceless and continue standing out in the market, Mastercard needed to move beyond talking about what’s Priceless to taking proactive actions to creating more inroads into it.

Background

Situation:

The rise of the digital economy upended the traditional payments model. Consumers were moving away from physical cards to digital wallets.

During this disruption, Mastercard’s core business was transforming as well. A new growth opportunity had emerged: the same capabilities that made Mastercard such an amazing card servicer could be deployed for other businesses beyond facilitating payments.

Challenge:

Entry to the B2B services world wouldn’t be easy. Just like payments, it was crowded with competitors but in this world, Mastercard was a new entrant vs. established incumbent. They needed to drastically shift perceptions of themselves as simply a being an engine of consumption to an engine of inclusion powered by innovation.

Objectives:

Mastercard had always differentiated with Priceless. By focusing it into financial inclusion, they gave themselves not only an altruistic mission but a powerful business strategy: the more people have access to economic opportunity, the better for them, the world, and for Mastercard.

With “doing well by doing good” as our north star, we examined communities being excluded from the financial system. We started with solutions that leveraged our core product and have grown our ambitions to uncover more creative unlocks.

Strategy & Process

We used quantitative and qualitative research, and connected directly with the communities we were trying to help. We turned to experts in accessibility – LGBTQIA+ advocacy organization GLAAD, The Royal National Institute of Blind People, VISIONS/Services for the Blind and Visually Impaired, the Alzheimer’s Society and the Polish government agency helping Ukrainian refugees.

From our interviews and research, we uncovered structural issues riddling the financial system barring these communities from thriving.

Issues like:

Credit card security protocols forcing transgender and non-binary people to use their birth names against their will.

Partially-sighted people unable to distinguish between credit cards due to ubiquitous design.

Legal hurdles blocking the way of caregivers in helping those with dementia manage their finances.

A critical lack of guidance for Ukrainian refugees who had fled in Poland on how to rebuild new lives.

Solution Design + breakthrough moment

All these challenges had been accepted as “unsolvable,” within the traditional system, but acting as an engine of inclusion, we could use our network, technology, and partnerships to unlock new solutions.

Experience & Implementation

The work that followed centered on answering one single question:

What’s the most priceless action we could take that'd turn exclusion into inclusion for these marginalized communities?

Implementation:

For the transgender community, we took on long-standing credit card regulations and overhauled infrastructure to create True Name - the first credit card people could use their chosen names.

For the partially-sighted, we innovated on card design and the entire manufacturing and distribution process to bring to market the Touch Card which used notches to allow anyone to tell their cards apart with a touch. This had the larger effect of transforming category standards for accessibility.

For dementia patients, we simplified a complex UX riddled with legal barriers. Sibstar was an app and card that let caregivers seamlessly put guardrails around their loved ones' spend.

And for Ukrainian refugees fleeing the Russia-Ukraine war, we built “Where to Settle.” A revolutionary app that aggregated the power of Mastercard’s and the Polish Central Statistical office's anonymized data, to direct users on where they should settle in Poland based on their personal conditions.

Business Results & Impact

This creative strategy shifted Mastercard from being just an engine of consumption to becoming an engine of inclusion powered by innovation.

It provided powerful tailwinds for Mastercard’s brand vs. competitors:

Socially-Conscious: +14 pts vs Visa

Innovative: +16 pts vs Visa

Customer-Centric: +27 pts vs Visa

Visionary: +45 pts vs Visa

And grew both brand and business, landing hundreds of new, global business deals:

Mastercard’s revenue is up 67% since 2018.

Mastercard’s brand value is up 56% since 2018.

True Name: available to 900M people in 32 countries

Touch Card: available to 200M people in 10 countries

Sibstar: available to 67M people in the UK, with more countries coming

Best of all, our efforts have created a step change in greater financial inclusion:

True Name inspired competitors like Visa and JP Morgan to amend their own practices and create similar products.

Touch Card and Sibstar spurred conversations around accessibility and dementia.

And Where to Settle is estimated to have benefited 20% of Ukrainian refugees in Poland. Moreover, our efforts changed how refugees can participate in host countries to become net contributors to that economy.

Transforming business and impacting society? Now that's priceless.

More Entries from End-to-End Transformation in Creative Business Transformation

24 items

More Entries from McCANN XBC

24 items