Glass: The Lion For Change > Glass: The Lion for Change

DABBA SAVINGS ACCOUNT

McCANN, Gurugram / ESAF SMALL FINANCE BANK / 2024

Awards:

Overview

Credits

Overview

Why is this work relevant for Glass: The Lion for Change?

India still is largely a patriarchal society. Indian women, especially in under-developed rural areas, are raised to be homemakers. The education, decision-making power, and financial growth of men is many times prioritised over that of women. Many of these women don’t even have a bank account and depend on their men for finances.

ESAF bank caters to marginalised households with 80% of our customers being women. We wanted to bring rural women to the formal banking system by making it easier for them.

The Dabba Savings Account simplified banking for them, with a tailor-made experience. We enhanced their saving tradition to be safer, and placed transaction facilities in spaces that were comfortable and safe for them. Deposits at women-only gatherings, and secure withdrawals at rice shops they frequented.

The women reduced dependency on their husbands for finances, watched their savings grow, and felt empowered and respected in their households.

Please provide any cultural context that would help the Jury understand any cultural, national or regional nuances applicable to this work.

In India, the education, financial growth and decision-making power of men is many times prioritised over that of women. Women, especially in under-developed rural areas, are raised to be homemakers in a patriarchal society. Many lack formal education, lack empowerment, and take over a daily routine of chores at home.

Therefore, when it comes to their family’s finances, they have almost no say. Most of them don’t even have a bank account. But they do know the value of saving. In the hopes of saving whatever then can, they try to keep loose cash in a ‘Dabba’ (a steel rice canister) in their kitchens. They believe this act is auspicious. However, it remains vulnerable to the men in the family – who take it away.

ESAF Bank, catering to marginalised households, wanted to help change this situation. We aim to empower these women and bring them to the formal banking system.

Background

ESAF Bank has a customer base with 80% women. Being a social bank that caters to marginalised households, we wanted to bring the benefits of formal banking to the marginalised women of rural India.

25% of Indian rural women still do not have a bank account. These women didn’t find traditional banking very feasible. Moreover, they believed it to be auspicious to save cash in a rice dabba in the kitchen. But the men in the family took it away. It was a saving tradition that lacked security.

The brief from ESAF Small Finance Bank, was to make these marginalised women a part of the formal banking system.

Our objective was to get these small savings to the safety of a bank and give them an opportunity to grow their money. In turn empowering these women and making them part of the banking system.

Describe the cultural / social / political climate around gender representation and the significance of the work within this context

Marginalised women in rural India live very differently from the rest of the population in the higher social strata. This is a culture where women are primarily homemakers, and their education or financial independence is not a priority. The lack of this puts them in an inferior position to their men, and they do not have much decision-making power.

But they do know the value of saving a little money. They believe it is auspicious to save cash in a rice dabba in the kitchen. But men in the family take it away. It stunts their financial growth.

These women have monthly meetings in the village that they attend without men. This is a platform where they could address issues and find solutions in the solace of fellow women.

ESAF Bank wanted to give these women financial growth to gain a little independence. But considering their living conditions, our solution didn't end at successfully making them a part of the banking system.

Once we introduced the Dabba Savings Account to them at their meetings and implemented it in the village, we made efforts not to publicise the product with no advertising or PR – for the sake of their privacy.

Describe the creative idea

We re-created the steel rice dabba to have a partition hidden in plain sight. While the top section continues to store rice, the hidden bottom section could safely store the women’s cash. So that they can continue their tradition of saving, without the men in the family taking it away.

Further, we provided a Savings Bank Account for them. We also facilitated easy deposit and withdrawal systems that were a part of their daily rural lives. So they don’t have to forego their household chores, while spending a day traveling to the town, just to go to the bank.

Describe the strategy

While these women could definitely benefit from a bank account, it was clear that they needed to keep it a secret. How do we distribute these Dabbas to the women without attracting the attention of the men in the family? How do we integrate formal banking into their village lifestyle?

We figured there is a women-only village gathering they attend monthly. They also frequent their neighbourhood rice shops to restock rice. These places could be our touchpoints to integrate banking facilities for the women.

For the sake of their privacy, we also wanted to keep the whole project a secret amongst the women – with absolutely no publicity.

Describe the execution

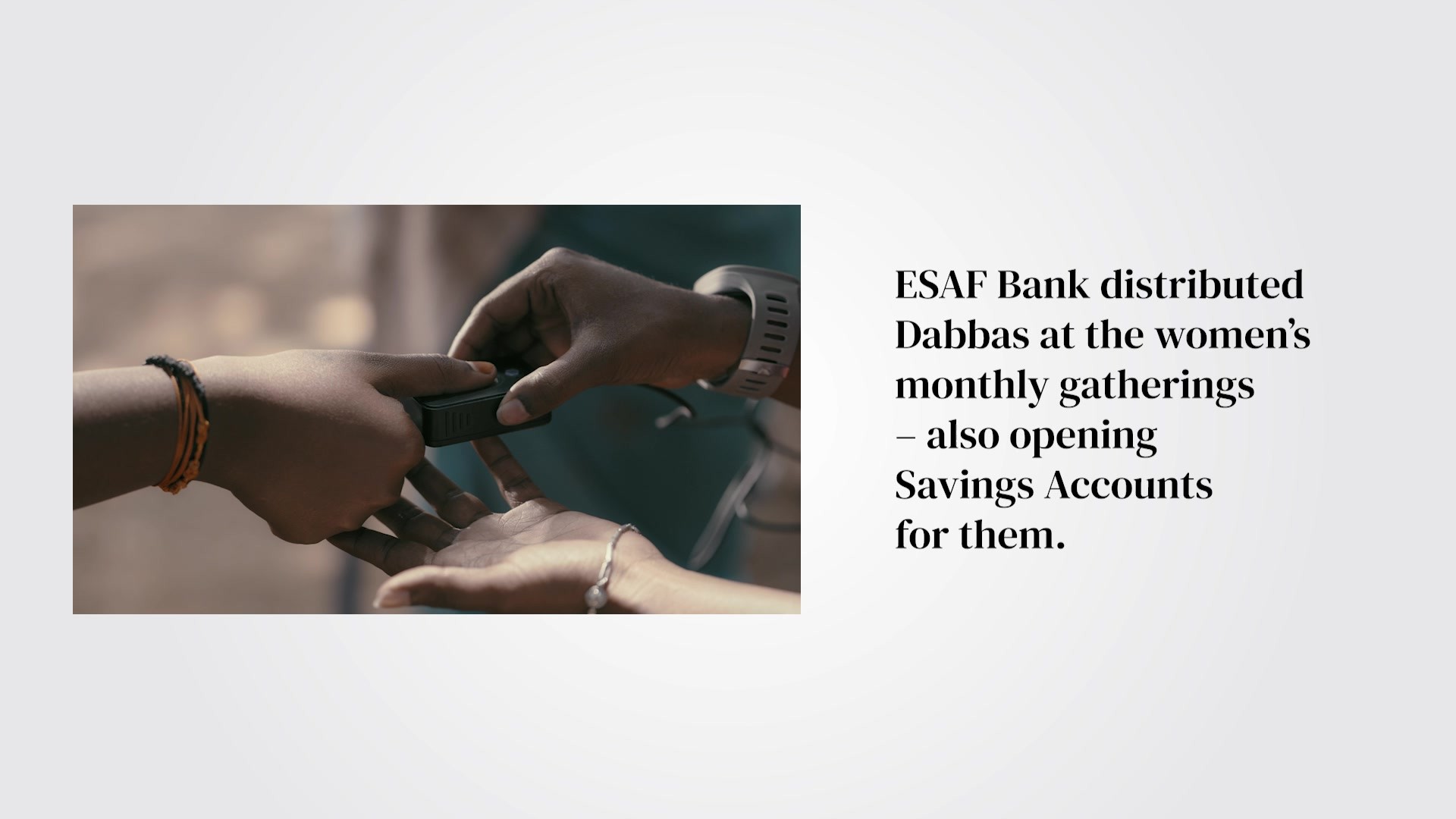

Our female bank employees began attending the women’s monthly gatherings. We demonstrated how the new Dabba works and where they could hide their cash. We distributed these Dabbas to them while opening ESAF Savings Accounts in their names.

The women continued their habit of saving, now with safety. They brought these savings to the subsequent meetings, which we collected and deposited in their accounts.

We also created an easy withdrawal system for the women - at the rice shops they frequent in the neighbourhood. We equipped the rice shopkeepers with micro-ATMs having India’s unique biometric technology - Aadhaar. The women could authenticate with a fingerprint, and the shopkeepers handed them the cash.

We launched this project in eight of the under-served districts in Southern India as the first phase. However, we did not to do any advertising or publicity – so the women could keep it a secret amongst themselves.

Describe the results/impact

Within the first few months, we managed to get 121,670 women to open accounts, secretly.

They started doing bank transactions for the first time, no longer fearing banking formalities.

The feedback we got was very encouraging. Thanks to their new Dabba, they felt their savings reached the bank safely. They felt content in knowing that the money they saved for their children is now growing. All without visiting a bank. They felt empowered, no longer depending too much on their husbands.

A traditional, intimidating bank is now a friendly woman representative who is a regular at their village meetings. ESAF Small Finance Bank is now enjoying an image of a very understanding and trusted partner to these rural women.

Describe the long-term expectations/outcome for this work

The Dabba Savings Account is an introductory product for marginalised women in India to join banking. In doing so, it not only changed their intimidating idea of banking, but gave these women empowerment and financial independence in their own households.

With this, we proved banking is possible for those who lack education and live far away from banks, in the hopes that these won’t be barriers in the future for the marginalised to join banking.

The women no longer depended much on their men for finances. They felt they could now save for their children and watch it grow. All without complex paperwork or visiting a bank.

We began by launching this project in eight districts in Southern India. But looking at the positive impact, we decided to extend it to the whole country.

We believe that when a woman is empowered, her family prospers, and eventually the entire community.

More Entries from Glass in Glass: The Lion For Change

24 items

More Entries from McCANN

24 items